What is sales effectiveness?

There isn’t one single answer. Some might say effectiveness comes down to performance against goals, while others might define it in terms of revenue or profit. Sometimes, it even gets conflated with sales efficiency. While both sales effectiveness and sales efficiency relate to the improvement of sales performance, efficiency reveals how fast sales reps complete tasks — but not whether they’re performing the right tasks. That’s the focus of sales effectiveness.

Because sales effectiveness is variable and unique to each company, it can be difficult to assess your sales team’s efforts. But without a clear definition of sales effectiveness, it’s impossible to get started measuring and, most importantly, improving.

To help with this conundrum, we’ve written a guide to provide a straightforward explanation of sales effectiveness and the metrics that matter. Read on and we’ll walk you through the process of identifying, measuring, and improving your sales effectiveness.

Table of Contents

- What is Sales Effectiveness?

- Defining Sales Effectiveness

- Discovering Best Practices

- Training and Optimizing

What is Sales Effectiveness?

Sales effectiveness describes the process of finding the right sales tasks to produce the best possible sales output and outcomes. For different organizations, this could mean improved profit, revenue, sales of a new product, or something else entirely — it all depends on how company strategy defines success.

The openness of this definition allows organizations to fill in details related to the specific results they want, because in order for sales effectiveness to really matter, companies need to know what success looks like for them and then determine the most effective ways to get those results.

So, how can organizations accomplish this?

Defining Sales Effectiveness

For organizations to improve the effectiveness of their sales force, they first need to define what effectiveness means to them and how to measure progress. This comes down to having realistic goals for specific sales metrics and key performance indicators for their company. Of course, in an ideal world, it would be best to boost all possible sales metrics — but in practice, it would prove too difficult to carry out improvement on that scale across an entire team. Plus, not all sales metrics are equally important. That’s why it’s important to prioritize and identify the most critical metrics that matter to your organization.

If your organization wants to expand into new territories, for example, it’s important to have a way to measure the processes that lead to winning sales in these new areas. If instead the priority is to improve sales productivity, the company must develop ways to measure how reps spend their time so they can look back and understand what needs to change.

These are just two examples, and there are many possible ways to define sales effectiveness. Some of the top sales metrics for organizations to improve include the following:

- Percent of sales reps achieving quota

- Quota attainment average

- Average annual on-target earnings

- Average new deal size

- Sales cycle length

- Vertical sales adoption

- Sales preparedness

No matter which sales metrics an organization decides to focus on, defining sales effectiveness is the first step to improving sales processes and targeting problems that need eliminating.

Discovering Best Practices

After defining sales effectiveness, identifying the metrics that matter, and assessing their effectiveness, company leaders will likely find that sellers regularly follow inefficient processes without even knowing it. By doing so, sellers end up wasting time and energy on systems and strategies that don’t have high return values, which prevents them from closing deals and winning more sales.

Once organizations gain clear measurements of their sales processes, they can ask a few key questions to find out which tasks are most and least effective:

- What doesn’t work?

- What works really well?

- How can what works get even better?

By asking and answering these questions, sales leaders can weed out the bad processes and get sellers to focus only on the ones that work best, increasing sales force effectiveness and improving win rates.

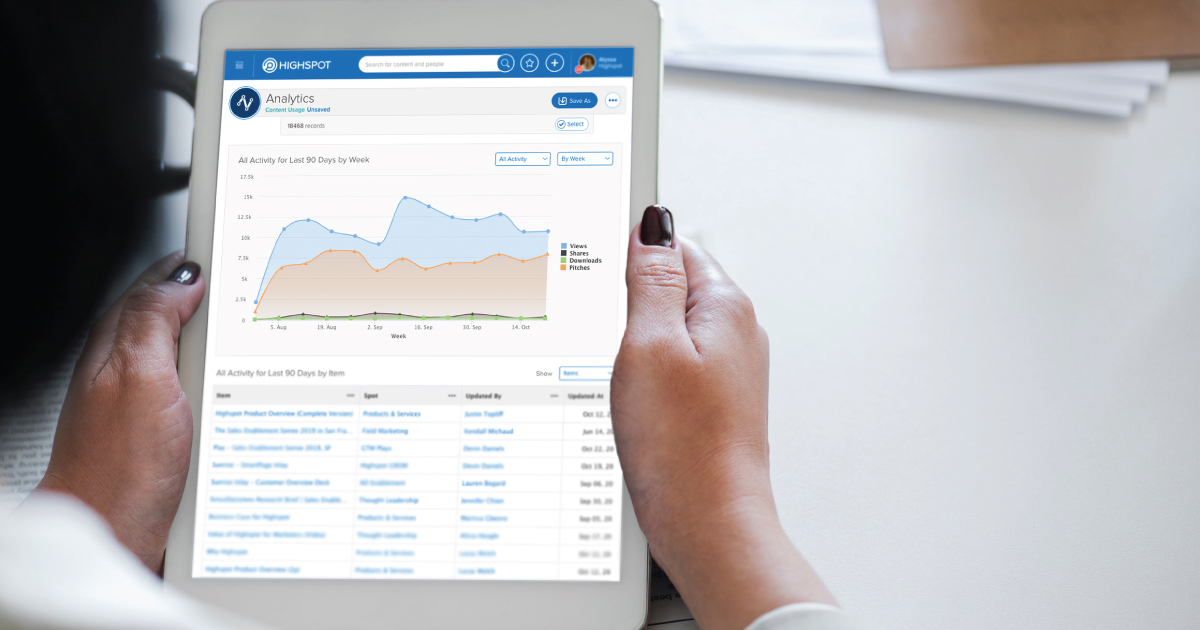

Sales enablement tools like Highspot help organizations simplify this process by giving them clear, accessible engagement analytics. By offering specific data on how various buying personas interact with sales pitches and content, sales enablement gives sellers the ability to target their processes to each unique buyer. Sellers that have the ability to see definitive data on what works and what doesn’t are able to use the most effective processes to target the right customers with the right content every time.

Training and Optimizing

It’s a great idea to identify and recognize top-selling reps, but organizations should also strive to improve the overall effectiveness of their sales force. After setting up processes to measure sales effectiveness, it becomes possible to take that data and turn it into repeatable actions for every seller to follow. Tools such as sales playbooks empower sales leaders to provide their teams with just-in-time coaching, talk tracks, training materials, and persona-based selling tips that are instantly accessible and contextual for any given sales situation. These best practices give even the lowest performing reps a boost by guiding them through the tried and tested practices of the top sellers, leading to higher win rates and revenue increases across the team.

With detailed content analytics, sales enablement tools make it easy for sales leaders and reps to discover best practices at every stage of the sales cycle. By measuring buyer engagement with content and providing real-time updates, tools like Highspot give sellers the help they need to optimize their sales processes and follow best practices.

There may not be one single answer to the question, “What is sales effectiveness?” — but that’s the point. Every organization must define sales effectiveness in terms of the goals and objectives that contribute most to its success. While the answers may differ, and end results may vary, the process of improving sales effectiveness looks the same. By identifying, measuring, and optimizing sales effectiveness, companies will ultimately develop the best practices they need to boost their sales team’s ability to succeed.